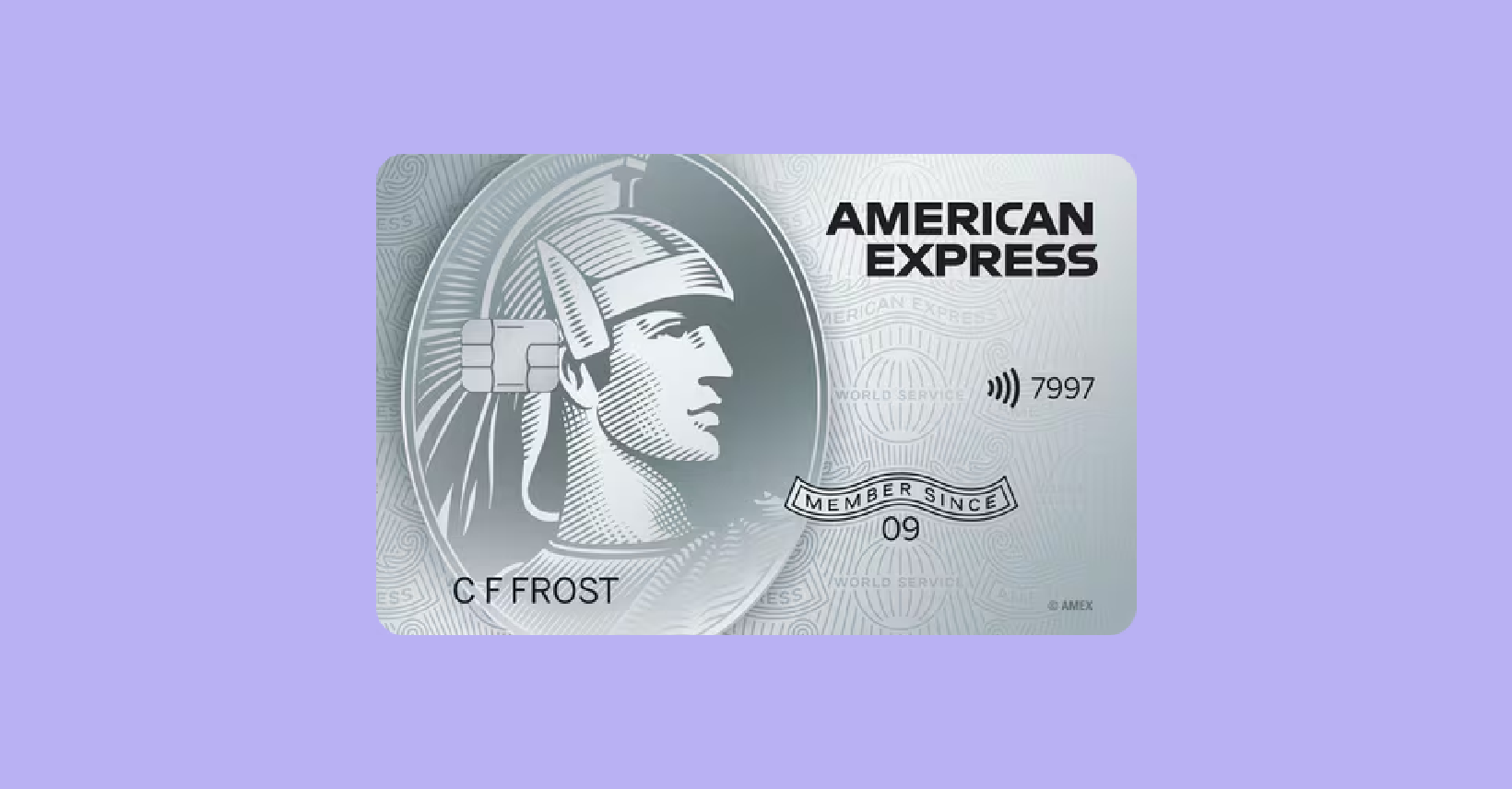

How to Easily Apply for an American Express Cashback Credit Card

Applying for the American Express Cashback Credit Card can be a smart move for savvy spenders in the UK. This card offers a straightforward way to earn money back on your everyday purchases, enhancing your financial well-being with reliable support. Whether you’re shopping for groceries or booking a holiday, every transaction gives you a chance to benefit from cashback rewards.

With the American Express Cashback Credit Card, you can enjoy generous cashback rates on eligible purchases, which can significantly add to your savings over time. Known for its convenience and trustworthiness, this card simplifies the process, requiring minimal paperwork and fuss. You’ll find it an invaluable tool for improving your financial flexibility.

The application process is simple and user-friendly, designed to help you get started swiftly and securely. Explore how you can take advantage of exclusive offers and benefits while elevating your spending experience with a card that’s reliable and efficient.

Discover the Benefits of American Express Cashback

1. Earn Cashback on Everyday Purchases

With the American Express Cashback Credit Card, you earn a percentage of your spending back as cash. This means you can benefit on every purchase you make, whether it’s groceries, fuel, or dining out. Tip: Use the card for regular expenses to accumulate cashback over time and get the most value from your spending.

2. Enjoy a Welcome Bonus

New cardholders often receive a welcome bonus to kickstart their cashback journey. Take advantage of this initial offer by using the card frequently during the introductory period. Tip: Plan your larger purchases or routine expenses during this time to fully benefit from the welcome bonus.

3. No annual fee for the first year

Another attractive feature of the American Express Cashback Credit Card is that it usually offers no annual fee for the first year. This allows you to experience the benefits of cashback without the commitment of a fee. Tip: Evaluate your spending habits in the first year to decide if the card continues to be worthwhile.

4. Access to Exclusive Offers

American Express offers cardholders exclusive deals and discounts from a variety of partners. These can range from online shopping discounts to perks at luxury hotels. Tip: Regularly check the American Express website or app to take advantage of these offers before they expire.

5. Reliable Customer Support

American Express is renowned for its reliable and efficient customer service, providing you with peace of mind. Whether you have queries or face issues, their teams are ready to assist you. Tip: Don’t hesitate to reach out for support; it’s there to ensure your satisfaction and confidence in using the card.

CLICK HERE TO GET YOUR AMERICAN EXPRESS CASHBACK

Key Requirements for American Express Cashback

- Minimum Age: You must be at least 18 years old to apply for the American Express Cashback credit card. This ensures that applicants are legally recognized as adults who can manage financial responsibilities.

- Residency: Applicants should be residents of the United Kingdom to qualify for this card. This is crucial because the card is designed to align with UK financial regulations and consumer protections.

- Credit Score: A good credit history is essential. While precise credit scores might vary, generally having a fair to excellent score improves your chances of approval. This reflects your reliability to pay back borrowed funds.

- Minimum Income: A minimum annual income is often required, typically around £20,000. This requirement demonstrates that you have the financial capability to meet monthly payments and additional expenses.

- Documentation: Be prepared to submit proof of identity, such as a passport or driver’s license, and recent utility bills or bank statements to confirm your address.

SIGN UP FOR YOUR AMERICAN EXPRESS CASHBACK TODAY

Steps to Apply for the American Express Cashback Credit Card

Step 1: Visit the American Express Website or Your Local Branch

To begin your application for the American Express Cashback Credit Card, visit the official American Express website designed for customers in the United Kingdom. Alternatively, you can visit a nearby American Express branch if you prefer a face-to-face interaction. The online platform is user-friendly, allowing you to easily navigate through the application process.

Step 2: Explore the Card Features

Before applying, it’s beneficial to understand the card features. The American Express Cashback Credit Card offers rewarding benefits like cashback on your spending. Review these features to ensure the card aligns with your financial goals, providing reliable financial support whenever you need it.

Step 3: Check Eligibility Requirements

Ensure you meet the eligibility criteria. Typically, the requirements include being over 18 years of age, having a permanent UK address, and a good credit history. Meeting these criteria enhances your chance of approval, reflecting the company’s commitment to responsible lending practices.

Step 4: Complete the Application Form

Proceed to fill out the application form with accurate personal, financial, and employment details. Ensure that all information is correct to avoid any application delays. American Express values transparency and clarity in their application process to assist you in making an informed decision confidently.

Step 5: Submit the Application and Await Approval

After completing the form, submit your application. You will receive a confirmation and, depending on your eligibility, a prompt response regarding your application status. American Express strives for a quick and efficient approval process, ensuring that you have access to your card swiftly.

REQUEST YOUR AMERICAN EXPRESS CASHBACK NOW

Frequently Asked Questions about American Express Cashback Card

What is the American Express Cashback Card?

The American Express Cashback Card is a credit card designed to offer users a straightforward way to earn rewards on their spending. Each time you make a purchase, you earn a percentage back in cash, which can be a practical benefit for everyday expenses. The card provides reliable and transparent rewards for those who like to see tangible benefits from their spending.

How does the cashback feature work?

With the American Express Cashback Card, you earn cashback on every purchase, which is calculated as a percentage of your total spending. Typically, new cardmembers may enjoy a higher cashback rate for the first few months. For instance, you might earn 1% cashback on all purchases after the introductory period. Cashback accumulated can be redeemed easily through your account statement, providing flexibility and convenience.

Are there any annual fees associated with this card?

American Express aims to provide value with its card offerings. Some Cashback Cards may come with no annual fee, allowing users to maximize their cashback without worrying about yearly charges. However, it’s important to check current terms as they can vary. Ensuring that your card terms align with your financial goals is key to making the right decision.

Is this card widely accepted across the UK?

Yes, the American Express Cashback Card is widely accepted across the UK. As one of the globally recognized brands, American Express offers reliable acceptance at a broad range of retailers, ensuring you can use your card conveniently wherever you choose to shop. Enjoy the benefits of cashback without concerns about where you can spend.

How can I maximize my benefits with this card?

To make the most out of the American Express Cashback Card, use it for regular expenses that you can afford to pay off each month. This not only helps you to earn impressive cashback but also facilitates building a healthy credit history. Take advantage of special promotions and partner collaborations that might offer enhanced cashback rates or bonus rewards, ensuring you are always maximizing your card’s potential.

Related posts:

How to Apply for the Halifax World Elite Mastercard Credit Card

How to Apply for HSBC Balance Transfer Credit Card A Step-by-Step Guide

How to Apply for the Amazon Barclaycard Credit Card Step-by-Step Guide

How to Apply for The Co-operative Bank Balance Transfer Today

How to Apply for a Barclaycard Avios Plus Credit Card Step-by-Step Guide

How to Apply for the Santander All in One Credit Card Online

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.